SoftBank Puts $2B Into Intel Amid U.S. Chip Act Talks

SoftBank invests $2 billion in Intel as U.S. pushes Chip Act, signaling confidence in America’s semiconductor future.

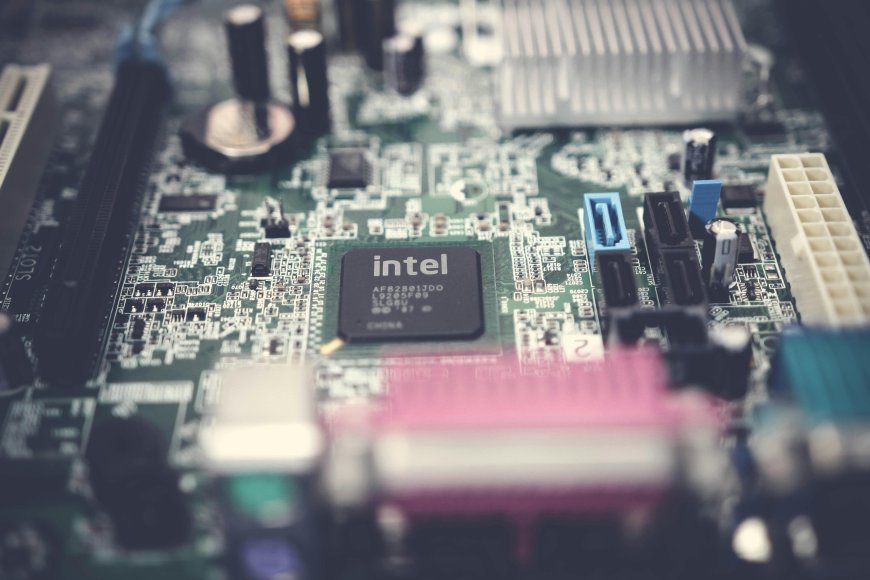

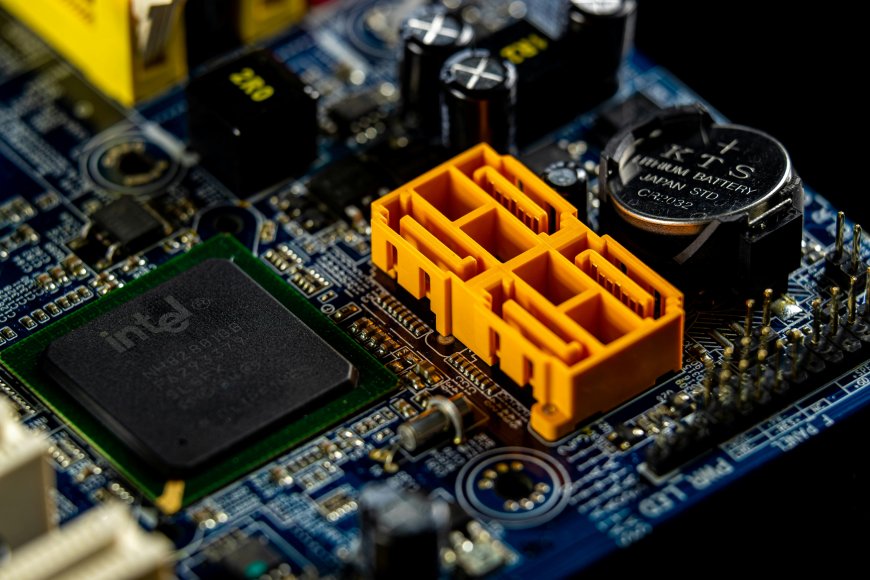

In a bold move underscoring the growing importance of semiconductors, Japanese tech giant SoftBank has announced a $2 billion investment in Intel. The deal arrives at a pivotal moment as Washington debates the long-term impact of the U.S. CHIPS and Science Act, designed to boost domestic chip production and reduce reliance on foreign supply chains.

Why This Investment Matters

Intel’s Revival Strategy

- Intel has struggled to keep pace with rivals like TSMC and Samsung in advanced chipmaking.

- CEO Pat Gelsinger has pledged to reclaim technological leadership by expanding U.S. fabrication plants.

SoftBank’s Global Bet

- The investment signals SoftBank’s belief in Intel’s turnaround.

- It aligns with SoftBank’s broader strategy of positioning itself at the center of AI, cloud computing, and semiconductor ecosystems.

The Role of the U.S. Chip Act

- Provides subsidies and tax incentives to companies building or expanding semiconductor facilities in the U.S.

- Aims to reduce reliance on East Asia, where geopolitical tensions pose risks to supply chains.

- Intel is one of the biggest beneficiaries, with plans for multi-billion-dollar fabs in Ohio and Arizona.

-

Industry Reactions

- Analysts: Many see the investment as a critical vote of confidence in Intel’s manufacturing strategy.

- Competitors: TSMC and Samsung continue to lead in cutting-edge nodes, but Intel’s U.S. expansion could shift the balance over the next decade.

- Policy Experts: The timing highlights how private capital and government policy are converging to reshape the global chip race.

Economic and Geopolitical Implications

- For the U.S.: Strengthens the case for semiconductor independence, particularly amid tensions with China.

- For Intel: Provides liquidity and validation of its long-term strategy.

- For SoftBank: Enhances its semiconductor portfolio beyond Arm, the British chip designer it owns.

Storytelling Moment

Emily, a graduate student in electrical engineering at Ohio State University, recently applied for internships at Intel’s upcoming chip facility in the state. “These investments aren’t just about technology,” she says, “they’re about creating thousands of high-paying jobs and keeping innovation here in the U.S.” Her story illustrates how global capital decisions ripple into local communities.

Looking Ahead

- Intel must still deliver on promises of technological parity with its Asian rivals.

- SoftBank’s backing could encourage more institutional investors to see Intel as a long-term growth play.

- The broader chip war between the U.S. and China will continue to shape strategy for all players.

-

Conclusion

SoftBank’s $2 billion bet on Intel is more than just a financial transaction—it is a statement of confidence in America’s semiconductor ambitions. As the U.S. government doubles down on its chip independence strategy, global investors are aligning behind companies like Intel to secure the digital backbone of the future.

FAQs

Q1: Why did SoftBank invest in Intel?

A1: To support Intel’s turnaround strategy and capitalize on U.S. semiconductor expansion.

Q2: What is the U.S. Chip Act?

A2: A government initiative offering subsidies and incentives for domestic chip manufacturing.

Q3: How does this impact Intel’s competition with TSMC and Samsung?

A3: It strengthens Intel’s ability to expand U.S. fabs and challenge Asian rivals over the long term.

Q4: What does SoftBank gain from this?

A4: Expanded exposure to semiconductors, complementing its ownership of Arm.

Q5: What does this mean for U.S. jobs?

A5: Intel’s new facilities could create thousands of high-paying technical roles, boosting local economies.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0